Understanding exactly who the local competition is these days is harder than ever before. No longer can saying, “you’ve achieved #1 in Google for these keywords” be all you focus on. Why? Because Google alters search results for people based on their location and other factors, to create a more personalized browsing experience. Ranking tools aren’t always consistent, and what shows as competition under one search, may not be the same competition for another. That’s why it’s important to do a competitive SEO audit, as part of your overall competitive analysis to get a better look at who the real competition is.

For this example, let’s say the client is an Italian restaurant in Clemson, South Carolina and has five main keyword phrases they want to rank for.

- Italian Restaurant

- Italian Restaurant Clemson

- Italian Restaurant Near Me

- Best Italian Restaurant

- Cheapest Italian Restaurant

Step One: Understand the Local Pack in Google

Start with the local map pack. Search the keywords the restaurant wants to rank for, and note who the three competitors are in the map pack for each. If you do not live in the same geographic area as the client, it’s ideal to walk the client through this process so they can conduct the searches from their local address. This is because Google uses the searcher’s proximity to the business as a weight in results. To emulate Google, we must pretend to be a local searcher.

Step Two: Create a Spreadsheet and Do Some Homework

In the spreadsheet, note the keyword phrases and the three competitors for each of them. Add a column for distance to the client. Note the addresses of each of the businesses in the map pack, because you’ll need them for the next step.

Step Three: Going the Distance

Next, search “directions” in Google, and you’ll be presented with a tool to get directions (and distances) from one address to another.

Enter the client’s business address, along with the address of their first competitor. Note the distance in the spreadsheet. Repeat the process for all the competitors in each of the five map packs.

Step Four: Measure

In a second column, note the greatest distance Google is going to fill out the results for each map pack. (I noted all the distances, because it was just as easy since multiple restaurants showed up in multiple map packs.)

Step Five: Identify Competitors by Strength

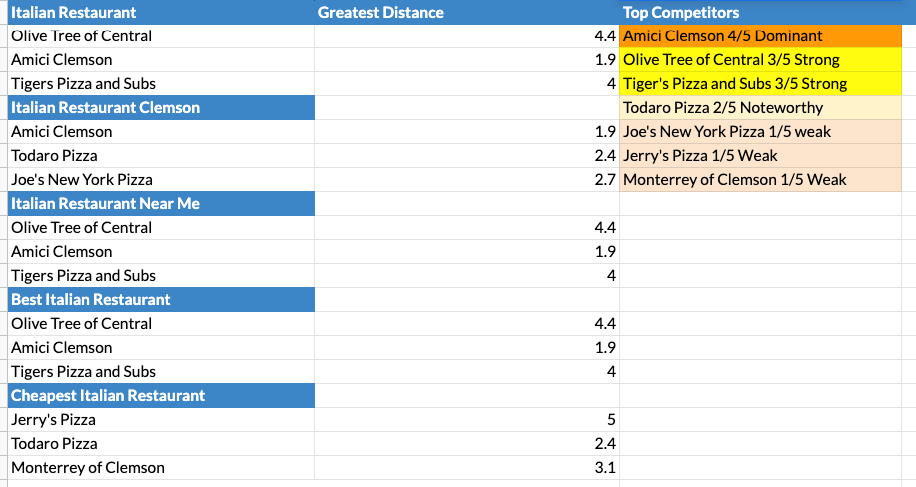

Rate the competitors by the number of times each one appears across all five local packs. The spreadsheet should look a little something like this:

Continuing with the example, we’ve learned:

Amici Clemson is the dominant competitor in the market, ranking in four out of five map packs. Olive Tree of Central and Tiger’s Pizza and Subs are also strong competitors because they rank in three of the five. Torado Pizza is noteworthy because it appears in two of the five. Jerry’s Pizza and Monterrey of Clemson are weak because they only appear in one. Closer inspection reveals Monterrey of Clemson isn’t an Italian restaurant at all – instead, it’s a Mexican restaurant with happy hour. That could still be considered competition, but it is indirect since they are not also an Italian restaurant.

The radius Google uses to find results varies depending on the phrase, and the more specific you get, the further out Google is willing to go. In most searches, there’s an option within a couple of miles, but in this instance, Google never goes beyond five miles.

With this information, you know who the client’s direct competitors are for their most desired searches, and how far Google is willing to go to make up a local map pack for each term. You’ve found the pattern of the most dominant competition across the top phrases your client wants to rank for, which tells you which competitors should be audited to uncover clues about the elements of their online presence that are making them strong.

Pros and Cons of This Approach

Pros

- You’re not limited to the vision of a single local map pack with a single set of competitors. The trends and patterns of dominant market-wide competitors can help you come up with a better strategy.

- You get to this set of competitors quickly, and know what you need to do to figure out what’s helping them, so you can ensure your client does it better.

- You get a useful view of the client’s target market, understanding the differences between businesses that are found across multiple packs, vs those that are one-offs and could be easier to beat.

- You may find extremely valuable intelligence for your client. For instance, if Google has to cast a net as wide as 15 miles to find an organic Italian restaurant, your client could start offering more organic items on their menu, writing about it more, and getting more reviews that mention it. This gives Google a new option to consider for the local pack that’s much closer to the searcher.

- It’s quick and easy to do for a business with a single location.

- Clients should be easy to convince of this because they’ve helped with the research. The spreadsheet is something they can understand immediately.

Cons

- You’ll depend on the client for help for a bit, and some clients aren’t good at participating with you, so you’ll have to convince them the value of conducting the initial searches for you.

- Manual work gets tedious.

- Scaling this for use with a multi-location enterprise would be time-consuming.

- Some of your clients are based in large cities and what to know what competitors are showing up for users across town and in different zip codes. Sometimes, it is possible to compete with competitors in other locations, but not always. This approach doesn’t cover this situation, so you’ll either be using tools that aren’t always consistent, or asking the client to go across town to search from that location, which could become a hassle.

This approach allows you to see who your competition is in the search results, so you’re not wasting time evaluating websites of other businesses that won’t provide good results.